30 Year Fixed Mortgage

What is a 30-year fixed rate mortgage loan?

A 30-year fixed mortgage is a loan with an interest rate that does not change for the entire 30 year life of the loan.

For example, on a $300,000 loan with a fixed interest rate of 5.00%, on a 30-year mortgage, the monthly payments will be $1,610.46. So, as long as you have that loan, the interest rate of 5.00% and payment stays the same.

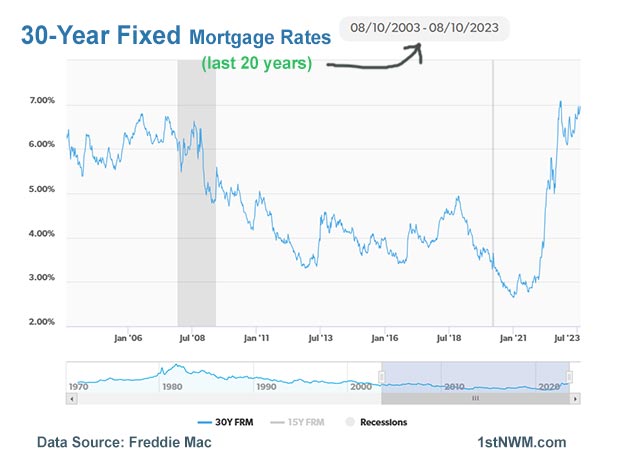

In 2023, borrowers are getting their loans closed with rates in the 6- to 7-percent range per the chart below. However, anytime a chart rises so dramatically in the financial markets it typically has a downtrend period that follows.

Which type of borrower should choose a fixed loan?

Borrowers who want a non-fluctuating set amount deducted from their monthly income are best prepared for 30-year fixed mortgages. These are who don't like surprises when it comes to monthy bills. Typically, if you plan to stay in the home for over 5 to 7 years, it's a great plan as you don't have to worry about the ups and downs of the financial markets.

30 Year Fixed Requirements

Keep your payments low without worry over rising rates.

- Down Payment: At least 3% of the purchase price

- Credit Score: Satisfactory credit report with a minimum 620 credit score

- Employment Income Verified through tax returns and/or paystubs

- Debt Ratios: Below 50. Although FHA may allow 54.9%

- Liquid Assets: Meet lender's funds to close and reserve requirements

Not everyone qualifies for a 30-year fixed loan. 1st Nationwide Mortgage Corp. will do its best to helps our clients qualify for loans with or without the traditional income qualification standards

30 Year Fixed FAQ's

-

What are the cons of a 30-year mortgage?

You pay more interest over the life of the loan than if you had a 15-year fixed or 20-25 year fixed.

-

What is a good reason to choose a 30-year fixed rate mortgage?

A 30-year fixed mortgage provides borrowers the lowest monthly payment compared to a 15-year fixed loan. The lower monthly payment permits a more manageable payment if you have a period of low income or being laid off or hospitalized.

-

Is a 30-year fixed mortgage better than a 10/1 ARM?

Currently, the mortgage interest rates for each are nearly identical. In this instance the borrower should select the 30-year fixed.